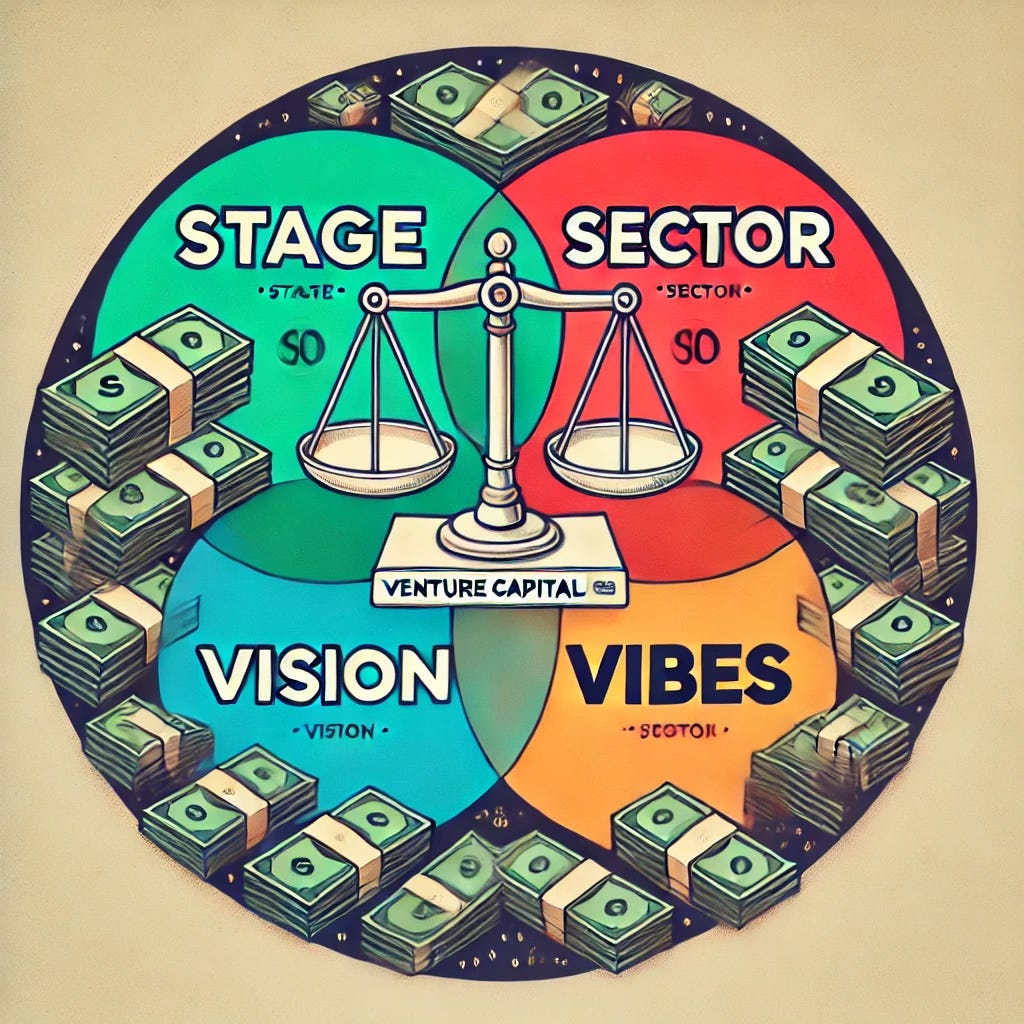

Stage, Sector, Vision, Vibes: A Founder's Guide to Picking a VC

In a world of seemingly unlimited VC partners, how should a founder pick the right one?

tl;dr for the busy: there are tons of VCs out there with similar messaging and it can be hard for founders to quickly calibrate on whether a partner or a fund is going to be a good fit for the round they are raising. I think figuring out alignment is the most important part of the fundraising process and I suggest the framework of Stage, Sector, Vision, Vibes to test that out. I included a few of my favorite questions to ask and flags to watch for below.

Now for those of you with slightly more time…

Indulge a quick tangent:

So, I try to avoid the most egregious of the VC cliches. I don’t own a pair of Allbirds. I’m more likely to wear a Patagonia vest on a hiking trail than in a board room. My email signature doesn’t flex Superhuman.

But coffee shop meetings? I’ll fully admit to that one.

A frequent coffee shop conversation that I have with founders is how do I figure out if this fund and / or partner is going to be a good fit for this fundraise? Like many questions, the answer is a nuanced one; for every clear cut yes or no, there are many ‘it depends!’. Thankfully there are pointed questions you can ask to demystify the ‘it depends’ case. I’ll include a few of my favorites below.

If there is one watchword I suggest founders optimize for, it is alignment. The four major areas I drill into to test that are: Stage, Sector, Vision, and Vibes. Thankfully I am not pretentious enough to title this blog post “Introducing the S2V2 framework”, but that does (annoyingly) help me convey it!

Let’s break this down across each of these areas:

Stage:

Is this investor a good fit for the maturity of your company?

This is simultaneously one of the easiest and hardest to figure out, depending on the fund.

Where it’s easy—the fund only does one stage, or a small handful of adjacent stages. For example, Pre-Seed/Seed, or Series A, or Growth. They have a sweet spot of where they like to invest (think: “first money in”, “post product & early monetization”, “above $5M ARR”), and a typical check size and ownership. As a result, it’s typically easy to qualify them in or out.

Where it can be tricky—multi-stage funds. Big funds that seem to be comfortable doing everything from seed through IPO. If you ask them what their typical check size is, they will tell you something along the lines of “it depends”, “we are flexible”, or “we are stage agnostic”.

The two things I think founders should care about: making sure you have an investor who understands the stage you are at, and making sure you are a core position, not an option. In my experience, it’s the best way to make sure that the investor is positioned to be helpful and that incentives are fully aligned and the fund is motivated to support you.

A few questions I suggest founders ask:

What were the last two or three investments this partner or fund made? Were those companies at a similar stage to yours, or completely different?

Is the proposed investment going to be big enough to “move the needle” for the fund?1 A blunt but directionally helpful test I like to use - divide the fund size by 50. That is likely the “typical check size” for the firm.2

How many board seats / active investments does the partner have? How do they like to engage with founders they invest in?

Flags to watch for:

Funds treating your company as an option. It’s unlikely you will get much value from them beyond money. And you may have to deal with signaling risk.3

Funds who clearly will not invest at your stage who want to take your time with multiple meetings (one initial get-to-know-you for down the road is fine). They are likely just fishing for information, considering an investment in a competitor, or someone junior who needs to hit a quota of companies they speak to that week.

Funds who are investing at a different stage without a clear explanation of why. It’s fine for a firm’s strategy to evolve to embrace a different stage. But you want to avoid people being “tourists” at stages they do not understand; it’s unlikely they will be helpful and patient over the long-term.

Sector:

Does the investor understand the domain you are building in and are they equipped to help you?

Venture is broken into worlds of “specialists” and “generalists”.

Specialists have a domain they spend the bulk of their time in, e.g. fintech, commerce, software infrastructure, cybersecurity, defense / space / “national dynamism”, crypto. Again, it’s typically easy to qualify them in or out.

Generalists, as the name suggests, are happy to pursue opportunities across different domains. They might know a space thoroughly through a thesis they are pursuing or a prior investment, or they might be approaching it without a lot of context.

I think, for early-stage, it’s helpful to have someone who has some degree of knowledge in the domain you are building in. This might be a specialist investor who only spends time in that domain, or it might be a generalist who has a thesis on the space. I believe it’s helpful but matters less for growth rounds which are more about metrics.

Questions to ask:

Do you have a thesis in our space? What other investments in this domain have you made?

How can your network help accelerate the trajectory of our company? Do you have potential customers you can connect me with, or domain experts who could be helpful advisors?

Does this investor lend a “halo effect” from having made other good investments in this domain?

Potential flags:

If the investor does not understand your space or have a network there it’s unlikely they will provide much beyond money. This can be fine if they are passive and / or you don’t want help, but may lead to tension if they want to be active.

Is the investor looking for an experimental “play” in a hot new space? If so, their enthusiasm about your company might wane as excitement around the space cools.

Vision:

Investors should be long-term thought partners. Is the investor someone is aligned with your vision, and who can help you think five to ten years ahead? A good investor will be a sounding board on key hires, market shifts, and fundraising strategy. If they have backed similar companies, they will have good instincts for what has worked (or not) and what milestones matter. They should also understand that markets change, pivots happen, and the founders are responsible for making the call on the direction of the company.

Questions to ask:

Does the investor have experience with analogous businesses?

Do they have a good sense of what kinds of outcomes and milestones are reasonable within a certain timeframe? An enterprise SaaS company has a very different trajectory than a deeptech company or a consumer company.

Potential flags:

Does the investor have really strong views about which direction the company should go in which do not map to what you think makes sense? Are they trying to pattern match with something which is not relevant?

Does the investor have unrealistic exit timeline expectations?

Vibes:

Can you see yourself working well with this investor?

If the business works, you will be spending a ton of time together over the next decade. They will of course be there for you to cheer your successes, but you also need them to be calm and solutions-oriented for your setbacks. Ideally you will genuinely enjoy spending time with this person and also value their input.

It’s worth noting this is not a “are we going to agree on everything” test. During the fundraise, both parties might play up shared interests and be overly nice to each other. This is great, and investors and founders often do end up being close, but not what you are testing for here. You want people who will hold up the mirror and push you when required, but also remind you it’s not all bad at your low points. There is an inherently emotional and personal part of founding a company, and you will want someone who invests the time to understand you and your motivations.

Questions to ask:

Is this person going to provide thoughtful feedback and push me as a founder to be the best I can be?

Can you “disagree well” with this person?

Potential flags:

Is the investor you are building a relationship with consistent in their actions, and is that consistent with their reputation? Do references :).

In Lehmann’s Terms:

Fundraising isn’t just about money—it’s about picking the right partners for the long-term. Stage, Sector, Vision, Vibes is not an exhaustive test, but if an investor doesn’t fit across these dimensions, they may not be right for your company. Ultimately this is more an art than a science (it’s tough to quantify how aligned you are with someone!), and I encourage founders to go with their gut intuition.

If you are raising or recently raised, I’d love to hear what worked for you. Drop me a comment or send over a message - as you know, I’m always down for a coffee chat!

Say you let a $500M fund invest $1M into your seed round. Even if you 10x their investment, $10M in proceeds will not have a material impact on the performance of their fund.

Why 50? Consider 25 portfolio companies per fund, with an equal ratio of initial investment dollars to reserves. Yes, there is more nuance to portfolio construction than that, so there are limits to how helpful this is. But say the “divide by 50” test gets you to 8, and you are trying to raise 5, it’s likely a fit. If the divide by 50 test gets you to something which is a different order of magnitude to what you want to raise, dig deeper, the fund may not (literally) be fully invested in your success.

The basic concept of signaling risk is that if a big firm has a small position on your cap table, then it can be a negative signal if they do not step up to do the next round. There are several good articles about this already so I won’t belabor the point here, although I will probably write more with my own take another time.

Some of the best advice a founder can ask for